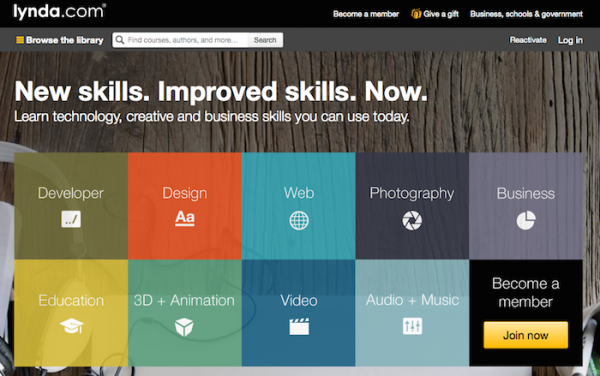

via Lynda.com

$186 million Lynda.com investment a great sign for digital publishing

A Lynda.com investment round announced on January 14 demonstrated a renewed commitment to both education technology and digital publishing.

The subscription-based service, which produces video tutoring and other learning materials, received $186 million in capital from a group led by international firm TPG and including current Lynda.com investment firms Accel Partners, Spectrum Equity, and Meritech.

According to Lynda.com, the investment will be used for acquisitions, content efforts, and staffing.

The attraction for TPG to a significant Lynda.com investment is the latter’s strong subscription model and audience development.

The firm’s David Trujillo will join the Lynda.com board.

“Lynda.com has built a leading subscription-based internet learning platform offering professional software, creative, and business training that attracts both corporate and individual customers,” Trujillo said in a statement.

“We are excited to partner with the lynda.com team to help the company continue gaining market share in a fragmented industry with long-term macro tailwinds. TPG looks forward to leveraging its operational experience with disruptive and innovative internet companies as the company expands its enterprise business and reshapes continuing education.”

Lynda.com CEO Eric Robison spoke of the company’s strategy with clients – which total 5.4 million in individual and corporate subscriptions.

“We find that once we get into a company, whether it’s a state government or an academic institution, it tends to be bottom-up,” Robison told The New York Times. “We start small and then we expand. Learners are invested in making sure their skills are up-to-date and there’s a lot to stay up-to-date on.”

The service plans to expand on its more than 5,700 courses and 255,000 video tutorials – which include English, French, German, and Spanish options. Current clients for the California-based company include 50% of the Fortune 50, a third of the country’s colleges and universities (including the entire Ivy League), numerous state governments, and every branch of the military. According to the Times, Lynda.com made $150 million in 2014.

So, what attracts all of those people to Lynda.com?

We consider Lynda.com a Subscription Website Archetype. It’s a course website with video as its Minimum Information Unit (MIU), but it also offers transcripts and other content. Lynda.com subscriptions start at $25.

The company is maximizing its freedom and flexibility as a multiplatform publisher. While Lynda.com might not be the first site that comes to mind when you think online publishing, there are several lessons you can learn from its approach – and the recent $186 million Lynda.com investment is a sign that whatever it’s doing is working.

First, Lynda.com’s focus on video is instructive. Video and other multimedia are rapidly emerging as a must for publishers.

Second, the multiple subscription tiers and access options for registrants that Lynda.com offers can help publishers considering such a model wrap their heads around the strategy.

Third, they have a great site and social media working together.

What do you think of the massive Lynda.com investment? Struggling with a subscription publishing model? Check our free handbook to sharpen your tactics.

To read more about the record-breaking Lynda.com investment, visit The New York Times’ Bits blog.