Recurring subscription billing has been around almost as long as credit cards

Last week I wrote about recurring billing software for subscription websites. When a customer agrees to have a specific charge card billed a certain amount for a pre-determined (or sometimes open-ended) period of time, that’s recurring billing. It’s sometimes called recurring payment or subscription billing. Bank accounts and debit cards can also be billed recurrently. Some billing software even accepts Apple Pay and Bitcoin. Common time frames are monthly and quarterly.

Subscribers like recurring billing for several reasons. First, they can essentially finance a subscription, making a payment each month. Second, they can commit for a shorter period of time, allowing them to evaluate the service or publication before subscribing for a full year. And third, it’s a convenience—one less bill to pay each month or quarter.

[text_ad]

You can offer recurring billing in several ways.

Open-ended

This is sometimes referred to as ’til forbid.’ When the subscriber initially signs up, he agrees to allow an automatic charge to a credit card each month, unless and until he contacts you to unsubscribe.

Limited time

When the subscriber signs up, he agrees to allow an automatic charge to a credit card each month for the next six months, unless he contacts you to unsubscribe. At the end of the six-month period, he receives a standard renewal notice.

Manual

For costly subscriptions that are typically built into yearly budgets, usually B2B or association-related, the subscriber may receive an email notice or phone call for renewal. The subscriber links to the indicated payment page, fills out the credit card information and is renewed for another month or year. This is not the most popular form of recurring billing, as the convenience factor is greatly diminished, and the renewal rate is greatly reduced.

In the past, an industry colleague of ours reported that phone calls dramatically improved renewal rates using the manual method. He estimated renewal rates at 30% without a call, and 50-60% if someone called them, and reminded them what they get with their subscription. He also estimated it added 5-12% to long-term renewal rates.

We prefer the open-ended approach, and tend to combine that with testing unique offers to increase subscription conversion rates. For a B2C multiplatform magazine publisher with a control offer of $19.99 for tablet, $24.99 for print, $29.99 for web and $34.97 for the combo, they could test the following offers:

- 7-30 day free access to the combo offer at the rates shown above

- $2.97/mo

- 30 days free and $2.97/mo

- $3 for 3 months

- $14.97-19.97 intro offer annual

- $.99 for first month, renews at $2.97/mo

A Few Things to Consider

Online publishers who use recurring billing experience increased income. However, there are a few areas to consider as you offer this option.

Declined cards

Over time, customer billing information can become outdated – cards are lost or stolen, or they expire. This outdated information can cause a payment delay, lost revenue, or even customer churn. And even though Mequoda’s chosen subscription software partner Recurly can update the card information in ways that prevent many declines from occurring in the first place, declines do of course still happen. When they do, Recurly works to turn the decline into an acceptance using two main tools: automatic retries and a process called dunning, which means contacting a customer to let them know about a decline. More on the optimal customer contact strategy here.

Chargebacks

When a customer disputes a specific charge to their card, banks automatically refund the purchase price and deduct the amount from your business bank account. You have the opportunity to prove that the transaction was legitimate, but this is often difficult. And banks will close your merchant account for excessive chargebacks. (Check your merchant account agreement for details.)

Customer complaints

If your customers are not fully aware of the recurring billing terms, you will get complaints, which can chew up time to resolve.

Copyright infringers

Recurring billing offers an easy opportunity for unscrupulous individuals to subscribe to your site, pay the first month or two, download what they want to keep and then cancel the subscription. But we believe the pros of offering recurring billing outweigh the risks associated with potential infringers.

An Ounce of Prevention

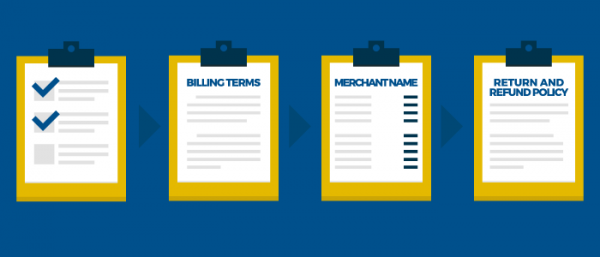

Many recurring billing problems stem from poor communication or when the online publisher and/or the subscriber have little experience in recurring billing. Review your site’s order flows with the following in mind:

- Double check your subscription order flow for simplicity, make sure it is easy to understand the offer

- State your site’s recurring billing terms in normal-sized print, on the subscription order flow

- State the merchant name that will appear on the credit card billing statement, especially if it’s different from your product and website branding, so the subscriber can easily identify the transaction

- State your return and refund policies in a prominent location

Recurring billing demands a pristine, fully bullet-proof payment processing module for your subscription site software. Gateways and merchant banks have perfected the system, and most support recurring billing.

Making sure this all works flawlessly will help you profit from the recurring billing option.

Editor’s note: This article was originally published in 2006 and has been updated.